Paying Off Mortgage Early Calculator Australia

You can also nominate when to start your increased repayment to take account of future pay rises or reduced expenses down the track. Using a mortgage broker.

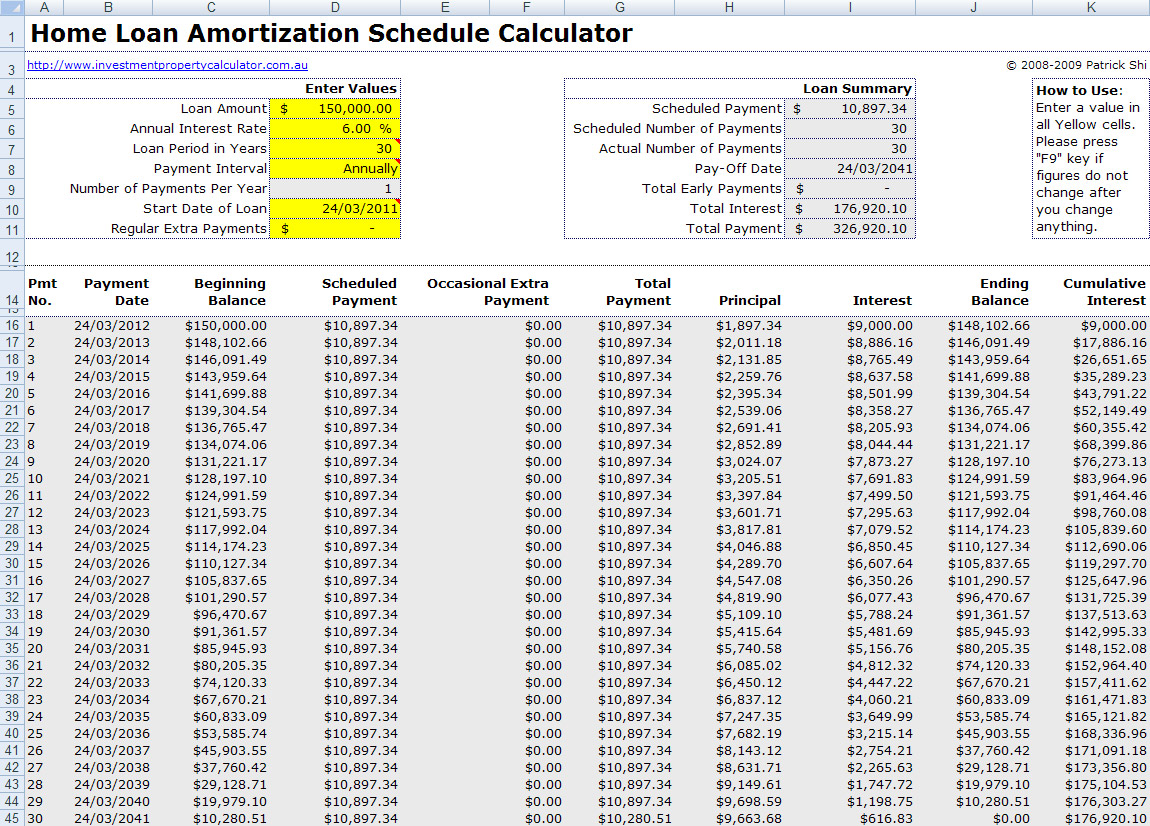

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

In only two minutes you could have an obligation-free indication of your borrowing power.

Paying off mortgage early calculator australia. Enter the principal balance owed. This calculator is only a guide. One way to pay off your mortgage early is by adding an extra amount to your monthly payments.

The results provided by this calculator are an estimate. In a macroeconomic environment that is full of insecurity home owners have a special responsibility and opportunity. This calculator requires you to input your home loan amount and your repayment frequency - monthly fortnightly or weekly - to calculate the estimated length of your loan.

This saves you a total of 1497819 in interest charges. Investor Home Loans Rates typically range from 250 - 600 Personal Loans Rates typically range from 400 - 1600 And aside from making repayments there may be other options to tackling these kinds of debt including debt consolidation loans refinancing your existing loan or balance transfer credit cards. The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment.

You will get a comparison table that compares your original mortgage with early payoff. Enter the regular monthly payment principal interest only. Enter the interest rate.

Find out how much you could borrow. Mortgage Payoff Calculator Extra Payments. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator.

Use our extra repayments calculator to see what this could look like for you. If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you could save and whether you can shorten the term of your mortgage. The take away here is that if you had waited to pay off your home loan by 10 years you are missing out on a decade worth of capital growth.

Keep in mind that the more frequent your repayments the more interest you are likely to save over the life of your loan. The calculations do not take into account all fees and charges. Check out our fortnightly repayments calculator or get in contact with a Mortgage Choice broker to find out how.

But how much more should you pay. Also gain some understanding of the pros and cons of paying off a mortgage earlier or explore many other calculators covering math fitness health and more. Extra mortgage payments calculator.

Compare the cost of switching your mortgage. By using this mortgage calculator you accept the terms and conditions. Based on Your Mortgages Extra and Lump Sum Calculator with a principal home loan amount of 800000 at 45 interest per annum over a loan term of 30 years additional monthly payments of around 2100 per month would need to be made if you are to see your loan term cut down to 15 years.

However fixed-rate mortgages typically have an annual overpayment limit of 10 of your TOTAL outstanding mortgage. NerdWallets early mortgage payoff calculator figures it. Applications made through your Aussie Mortgage Broker are subject to approval.

Its at 636 per cent interest that youll pay double what you borrowed in the first place. Theyll be able to help you find the right loan in amongst thousands across the market. Our mortgages section has lots more information on mortgages and paying extra off your mortgage.

Mortgage Repayment Calculator Australia Use this calculator to generate an amortization schedule for your current mortgage. Based on the example above if you add 50 to your monthly payment you can pay down your loan in 2741 years. 2 min read.

Calculate Monthly Australian Home Loan Repayments at Current Rates. Quickly see how much interest you will pay and your principal balances. Number of years to pay-off mortgage.

Free mortgage payoff calculator to evaluate options and schedules to pay off a mortgage earlier such as extra monthly payments a one-time extra payment a bi-weekly payment or simply paying back the mortgage altogether. In interest over the life of the home loan and paid off the loan. Alternatively if they put 100000 in their offset account most of the couples monthly repayment of 2387 goes towards paying off the principal quicker.

They would have saved 172000 approx. Pay Off Credit Cards. When you pay extra on your principal balance you reduce the amount of your loan and save money on interest.

And although no one is suggesting. Enter your current loan details or proposed loan details if you dont already have a mortgage then give your repayment amount a boost. Although it is true that many people found their houses to be a financial burden during the thick of the 2008 worldwide crisis those that were able to stay on top of their payments actually found that their real estate was more of an asset.

If youre on your lenders standard variable rate or youre on a tracker mortgage there is normally no limit on how much you can overpay your mortgage by. On top of the 550000 or thereabouts you paid for your house. Work out if youll save money by switching to another mortgage.

Conditions fees and charges will apply. Tips to Pay Off Your Mortgage Early. Six ways to pay off your mortgage early.

Keep in mind that you may pay for other costs in your monthly payment such as homeowners insurance property taxes and private mortgage insurance PMI. Mortgage Early Payoff Calculator excel is used to calculate early mortgage payoff and total interest savings by paying off mortgage early. To get the right home loan advice speak to our brokers.

Start your application online or call us on 1800 100. Meanwhile if you add 100 to your monthly payment you can pay off your mortgage in 25 years. Before overpaying your mortgage check that your lender allows you to overpay it penalty-free and if there are any limits as to how much you can overpay.

For a breakdown of your mortgage payment costs try our free mortgage calculator. How to work with a broker to get a better home loan deal. Pay off your mortgage faster.

The State Of Life Insurance In Australia An Infographic Via Sillymummy Com Mortgage Marketing Life Insurance Quotes Refinancing Mortgage

Invest Or Pay Off Mortgage Which Is Best Youtube

Best List Of Free Online Mortgage Home Loan Calculator Tools Australia Mortgage Calculator Tools Online Mortgage Mortgage Calculator

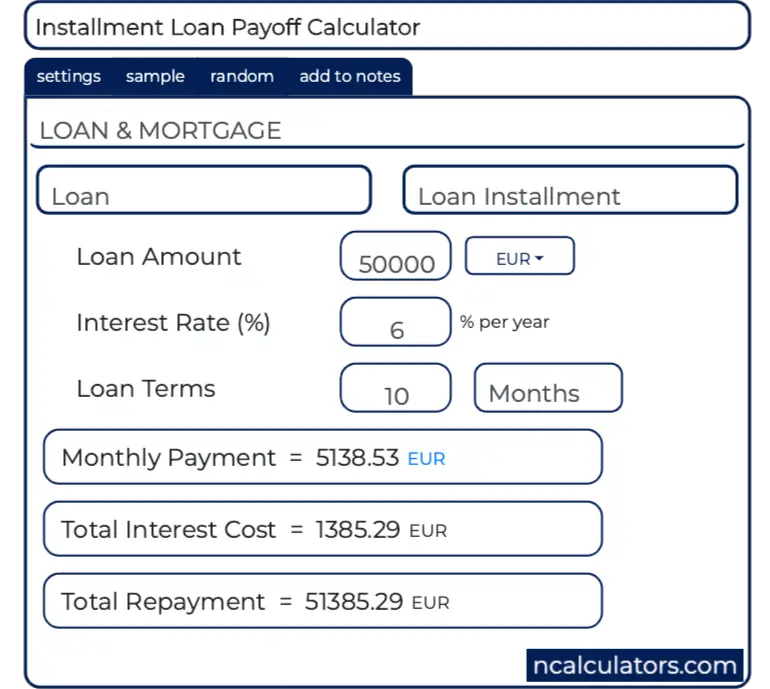

Installment Loan Payoff Calculator

How To Pay Off Your Mortgage Early Bankrate Mortgage Payoff Pay Off Mortgage Early Paying Off Mortgage Faster

How Long To Pay Off Mortgage Calculator Mortgage Choice Mortgage Payoff Mortgage Loan Calculator Mortgage Amortization Calculator

Are You Looking For Reasons Why One Should Need A Mortgage Broker In Australia Here Are Some Mortgage Brokers Mortgage Tips Mortgage

Reverse Mortgage Lifetime Loans For Seniors 60 Yrs We Have Practical Experience I Reverse Mortgage Mortgage Repayment Calculator Paying Off Mortgage Faster

Loan Pay Off Calculator For Irregular Extra And Balloon Payments Amortization Schedule Mortgage Payment Personal Finance Advice

Is It Really Practical To Pay Off Loans Early Your Mortgage Australia

10 Ways To Pay Off Your Mortgage Faster Mortgage Amortization Pay Off Mortgage Early Mortgage Amortization Calculator

Personal Finance Should I Pay Off My Mortgage Early Consider The Costs Bloomberg

Mortgage Tips And Tricks How A Mortgage Calculator Can Save You Bundles Of Dave Ramsey Mortgage Mortgage Payoff Mortgage Calculator

Should I Pay Off My Mortgage Early The Simple Dollar

Are There Disadvantages To Paying Off Your Mortgage Early Level Financial Advisors

Early Mortgage Payoff Calculator Personalfinance

Is It Really Practical To Pay Off Loans Early Your Mortgage Australia

Post a Comment for "Paying Off Mortgage Early Calculator Australia"